The UK government’s fuel duty policy has once again come under scrutiny as we approach the end of 2024. The policy was originally introduced in the Spring Statement of 2022 by the Conservative government. Rishi Sunak introduced the fuel duty policy to offset the rising cost of living amidst the Russian invasion of Ukraine and the consequential sanction on Russian-origin fuel.

The policy was initially set in place until March of 2025, however, there is speculation that the Labour government will be rescinding the policy to compensate for the funding black hole discovered earlier in the year and to further push their ‘green agenda’.

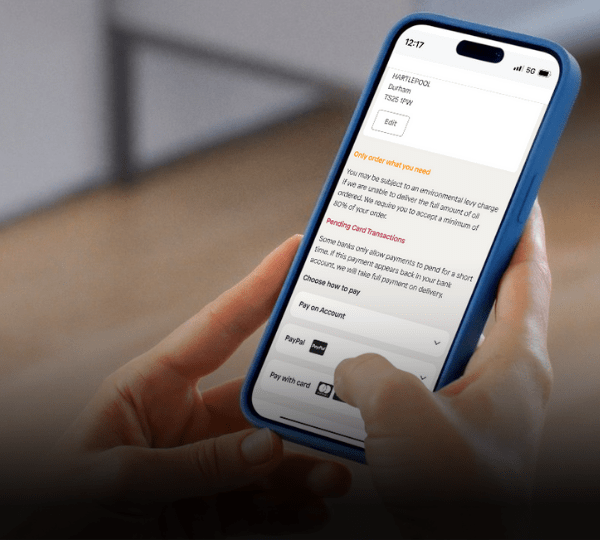

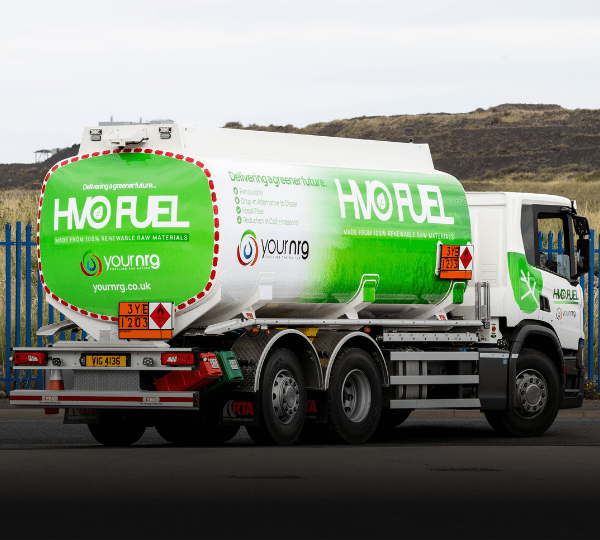

If the potential fuel duty change is set to go ahead it could majorly disrupt a decade-long duty freeze, with fuels such as diesel, petrol, and HVO Fuel facing a potential 5p+ hike in price. The fuel duty change will be mandatory, affecting the entirety of the nation. In light of these potential changes, we wanted to make our customers aware of the situation, enabling them to prepare for possible cost increases and adjust their budgets accordingly.

Key Takeaways

- What is the fuel duty policy?

- Past, present and future.

- What is the impact of the fuel duty policy?

- How much is the fuel duty in the UK?

- How often does fuel duty change?

- Why do fuel duty rates change?

- How is fuel duty calculated?

- Who pays fuel duty?

- Does fuel duty apply to all fuels?

- How does fuel duty affect businesses?

- Can fuel duty be avoided?

- How do changes to the fuel duty policy affect inflation?

What is the fuel duty policy?

Fuel duty is a policy in the UK whereby tax is imposed on fuels such as (but not limited to) petrol, diesel, and biofuels. It is applied to the price per litre (ppl) of fuel and is automatically included in the price that consumers pay for fuels used in vehicles and other operations. The rate is dependent on the type of fuel being used and sometimes what it is being used for, with commercial operations impacting the cost.

The fuel duty is one of two main taxes applied to fuel, with the other being VAT (which is added on top of the fuel price and the duty price). The current rate is 52.95ppl, which is in place until March 2025. However, the current speculation is this could be set to change for the first time in over 10 years.

Past, present and future.

Historically, fuel duty was introduced in 1908 as part of the “People’s Budget’ to raise government revenue. Throughout the years, fuel duty has also been used as a tool to influence consumers and reduce carbon emissions by excessive fuel consumption. The government has used fuel duty as an economic lever, adjusting the rates to support various policy objectives.

The fuel duty policy was capped in March 2022 by the Conservative government at 52.95ppl. However, in recent talks, Rachel Reeves has hinted that the Labour government may dissolve the cap in an attempt to fill the funding black hole identified earlier in the year.

The timeline so far:

- 2011; the fuel duty was reduced from 58.95ppl to 57.95ppl - where it remained frozen for a decade

- March 2022; Conservatives announce emergency 5p slash, reducing rate to 52.95ppl

- March 2023; Sunak extends 5p cut for another 12 months

- March 2024; fuel cut further extended

- October 2024; Reeves discusses removing cap to fill funding black hole

What is the impact of the fuel duty policy?

The fuel duty policy significantly impacts transport costs for both businesses and individuals. Changes to the rate can have wide-reaching economic impacts and implications, with the possibility of adverse effects negatively influencing inflation, consumer spending, and business costs.

How much is the fuel duty in the UK?

Currently, the fuel duty is set at 52.95ppl, however, this rate is at risk of changing with the announcement of Labour’s new annual budget. The forecasted change could see prices rising by a minimum of 5p, but could also see fuel costs inflating further, with up to 10ppl suggested.

How often does fuel duty change?

Fuel duty can change during national budgets or as part of fiscal policies. Typically, fuel duty is reviewed annually, although changes or updates may not be implemented despite the review. Changes made to the fuel duty policy are announced by the Chancellor of the Exchequer or the appropriate financial body.

Why do fuel duty rates change?

Fuel duty rate can fluctuate for several reasons:

- Revenue generation

- Environmental policies

- Political reasons

- Inflation adjustments

How is fuel duty calculated?

Fuel duty is a fixed amount per litre of fuel, which is included in pump prices or quoted prices.

Who pays fuel duty?

Fuel suppliers pay the duty to the government but the cost is passed onto consumers via the price they pay at fuel stations or from their fuel suppliers. Drivers and businesses using commercial bulk fuels effectively bear the cost of fuel duty.

Does fuel duty apply to all fuels?

The fuel duty policy mainly applies to petrol, diesel, and biofuels such as HVO Fuel. Alternative fuels such as agricultural diesel (also known as gas oil) are subject to a lower rate of duty, whereas kerosene (which is predominantly used for domestic heating or agricultural dryers), is a duty-free product.

How does fuel duty affect businesses?

Businesses that rely heavily on transportation, such as logistics, delivery services, and agriculture, are significantly affected by changes in fuel duty. Higher fuel duties increase operating costs, which may be passed onto consumers through higher prices for goods and/ or services.

Can fuel duty be avoided?

Fuel duty is stereotypically unavoidable for regular day-to-day consumers, but certain groups or industries may receive exemptions or lower rates. Illegally avoiding fuel duty is a criminal offence.

How do changes to the fuel duty policy affect inflation?

Fuel duty changes can have a significant effect on inflation, with increases in fuel duty raising transportation costs, which can subsequently affect the price of goods and services.