If you rely on domestic heating oil to keep your home warm or commercial bulk fuel to keep your business running, it’s time to pay attention.

Key Takeaways

- Will the Middle East conflict affect oil prices?

- Why does the Strait of Hormuz matter for oil prices?

- What does this mean for fuel buyers?

- What can you do right now?

- What’s the current price of heating oil in the UK?

- Who is the world’s largest oil producer?

- Trust Your NRG in a shifting fuel market

Will the Middle East conflict affect oil prices?

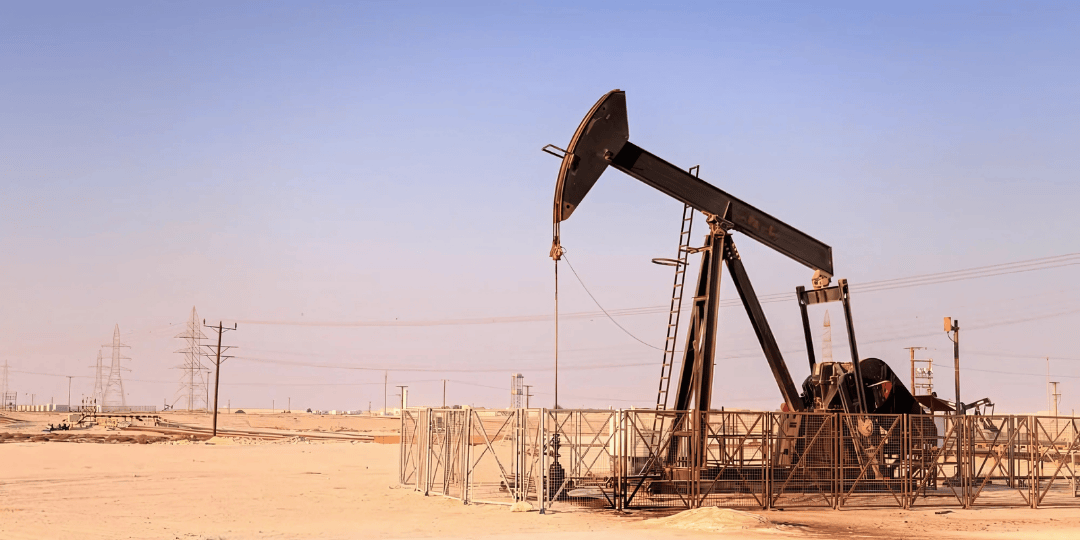

Yes, conflict in the Middle East often causes oil prices to rise due to fears of supply disruption. The Middle East is a major oil-producing region, and any military or political instability can quickly send shockwaves through global energy markets. When tensions rise, traders react by pricing in potential supply risks.

Why does the conflict in Iran affect UK fuel prices?

The short answer: global supply routes and market fear.

About 20% of the world’s oil flows through the Strait of Hormuz, a narrow waterway controlled by Iran. When conflict threatens that route, markets react quickly. Prices rise not just on speculation but on real concerns that supply may be disrupted, either by physical blockages, sanctions, or political fallout.

Why does the Strait of Hormuz matter for oil prices?

The Strait of Hormuz matters because around 20% of the world’s oil passes through it. Any threat to this route can lead to price spikes.

The Strait of Hormuz is one of the world’s most strategically important oil transit chokepoints. It connects the Persian Gulf to the open sea and is used by key oil-exporting nations such as Saudi Arabia, Iran, Iraq, and the UAE.

If this narrow waterway is blocked, disrupted, or threatened, as during the recent Iran-Israel tensions, global oil supply could be severely impacted. Even the fear of closure is enough to drive prices higher, as it raises concerns about availability and transport costs.

Ceasefire brings price drop already

As of 24 June, oil prices have fallen by nearly 5% following news that Israel has agreed to a US-brokered ceasefire with Iran. Brent crude dropped to around $68 a barrel, reversing much of the surge seen during the two-week conflict.

The price drop is good news for buyers in the short term, but it comes with a catch: both sides have already accused each other of breaking the ceasefire, raising concerns that volatility could return.

What does this mean for fuel buyers?

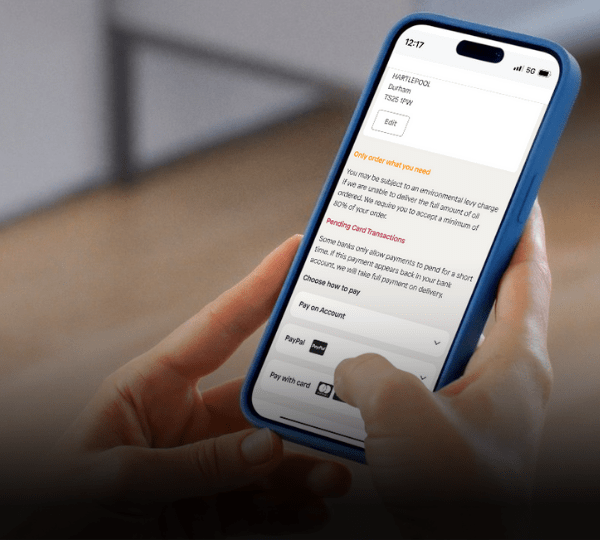

Homeowners relying on domestic heating oil often have some flexibility in when they order, which means timing is everything. With the recent dip, now may be a smart time to top up, particularly with cooler autumn months on the horizon.

If you're managing a fleet, running machinery, or fuelling plant equipment, any rise in commercial bulk fuel costs impacts your bottom line directly. Transport, agriculture, construction, and manufacturing businesses often feel the hit fast when fuel prices swing upward. Fuel budgeting becomes tougher, delivery timelines grow more urgent, and operational efficiency takes a hit. Many procurement teams are now weighing up forward-buying strategies or locking in supply through trusted fuel partners.

The recent price dip offers a chance to reassess supply strategies and explore fixed-price or scheduled delivery options that help smooth the ups and downs. While the ceasefire offers some short-term stability, the risk of renewed conflict or market reaction to any perceived breach means it’s smart to act now.

Speak to the team at Your NRG today about smarter fuel planning that keeps your costs under control and your supply secure.

Volatility is still the norm

Even with this ceasefire in place, the market remains sensitive. Oil prices are affected not only by real events but by the possibility of renewed unrest. And while current prices have eased, the situation could shift again quickly, especially if either side escalates or if shipping routes are impacted. That’s why making decisions based on service, supply reliability, and flexibility is just as important as tracking daily prices.

What can you do right now?

If you're concerned about rising fuel prices or want to lock in a bit more certainty, here are a few steps worth considering:

- Top up sooner rather than later. Prices may rise further if the conflict continues.

- Talk to us about fixed-price or scheduled delivery options. For businesses, this can be a game-changer.

- Use monitoring tools to track tank levels. No more guesswork – and no more urgent, high-cost deliveries.

- Stay in touch with your supplier. If you don’t hear from them when markets shift, that’s a problem.

What’s the current price of heating oil in the UK?

As of June 2025, the average price of heating oil in the UK is around 66–70p per litre, but rates vary daily based on global oil prices and local supply.

Who is the world’s largest oil producer?

As of 2025, the United States is the world’s largest oil producer, followed by Saudi Arabia and Russia.

The United States leads global oil production thanks to its advanced shale extraction and widespread infrastructure. In recent years, U.S. output has consistently exceeded 12 million barrels per day, driven largely by production in Texas, North Dakota, and the Gulf of Mexico.

Trust Your NRG in a shifting fuel market

In uncertain times, who you buy from matters just as much as what you pay.

At Your NRG, we supply both domestic heating oil and commercial bulk fuel across the UK with professionalism, speed, and transparency. We know how frustrating unclear oil pricing, delivery delays, or radio silence from your supplier can be. That’s why we focus on:

- Reliable deliveries from experienced drivers who turn up when they say they will.

- Transparent, competitive pricing that reflects the market without opportunistic mark-ups.

- Proactive communication, so you're never left guessing.

- Tank monitoring and planned top-ups that help you stay in control even when markets are unpredictable.

- Flexible account options for commercial clients looking to manage fuel budgets smarter.

Whether you’re a homeowner managing winter heating oil costs or a procurement officer responsible for keeping your site fuelled and running, we’ve got your back. Give us a ring or request a quick online quote. Let’s keep your supply steady, no matter what’s happening in the world.